Settings - Practice Management

Your CCH iFirm site contains some default tax types that you can edit. You can also add your own tax types, if they are required for other countries or regions.

Tax types are used on invoices. The default tax type is automatically applied to invoice line items, unless you edit it and select a new tax type. Click here to learn about editing the tax amount on an invoice.

- Click Settings > Practice Management.

- Click Tax Types.

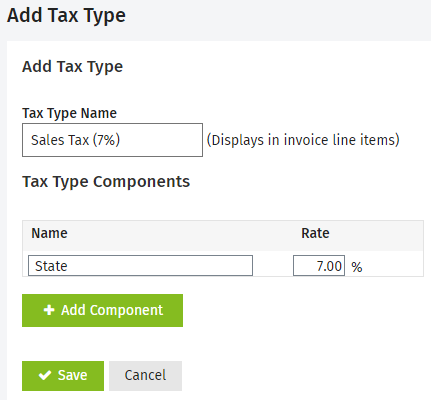

- Click Add Tax Type.

- Type the Tax Type Name.

- This is the name of the tax type that is displayed on invoices.

- This name can be a maximum of 20 characters.

- Enter the Tax Type Components.

- The Name is for your internal use.

- The Rate for the tax type should always have two decimal places, for example, 10.00%.

- Click Save.

- Click Settings > Practice Management.

- Click Tax Types.

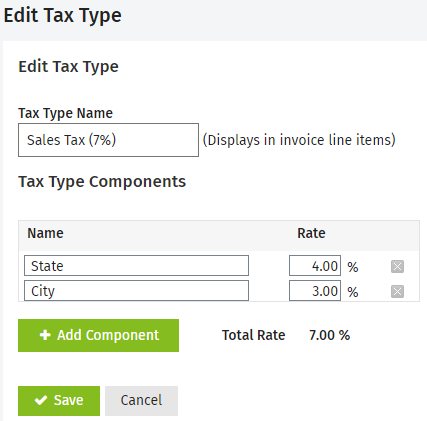

- Click the row of the tax type you want to edit.

- Edit the Tax Type Name, if required.

- This is the name of the tax type that is displayed on invoices.

- This name can be a maximum of 20 characters.

- Edit the Tax Type Component.

- The Name is for your internal use.

- The Rate for the tax type should always have two decimal places, for example, 10.00%.

- Click Save.

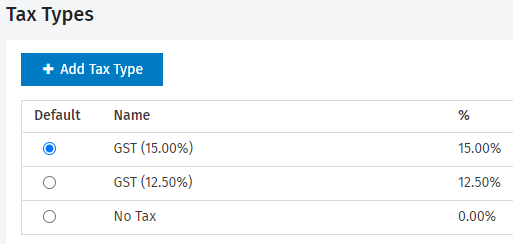

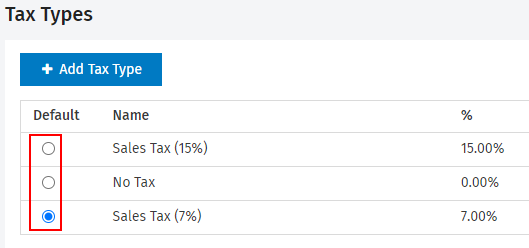

The default tax type is the one that CCH iFirm automatically applied to invoices.

- Click Settings > Practice Management.

- Click Tax Types.

- Select the radio button of the tax type you want to set as the default.

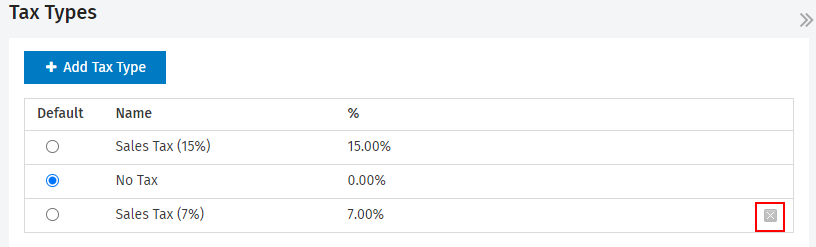

The default tax type cannot be deleted because CCH iFirm needs to have at least one tax type for creating invoices. If you have another tax type and is not in use, in other words, it is not assigned to an invoice line item (draft or finalized), you can delete that tax type. Once deleted, the tax type no longer appears on the invoice screens.

- Click Settings > Practice Management.

- Click Tax Types.

- Click the Delete button

on the row of the tax type you want to delete.

on the row of the tax type you want to delete. - Click Yes to confirm.